Auto SUV car prices dilemma

In the domestic SUV market, the highest-selling car is the lower-end car or the higher-end car? What is the performance of SUVs at all levels? According to the analysis of Gasgoo.com, there are signs of a decline in the share of low-end and mid-end vehicles in China's domestic SUV market, as well as an increase in the share of mid-range and high-end vehicles. The self-owned brands mainly compete in the shrinking market, and the autonomous SUVs entering the high-end market also face difficulties in surviving. In this competitive situation, the self-owned brand SUV is going to the middle and high-end, on the one hand, to deepen the low-end market. The following is the detailed content.

Most self-owned brand SUVs compete in the shrinking low- and mid-market

At present, the domestic low- and mid-range SUVs that are currently being sold in the Chinese market are all brand-name automakers without exception, while the SUV models of joint-venture car companies have all entered the high-end or high-end SUV market. Only a few of the self-owned brand models are in the mid- to high-end SUV market, but they have yet to enter the high-end SUV market.

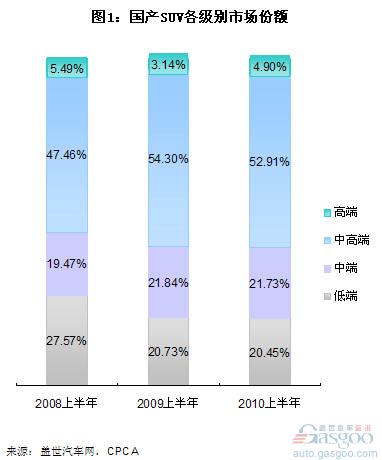

From the perspective of domestic sales of domestic SUVs in the first half of the year, the market share of low-end vehicles has dropped from 27.57% in the first half of 2008 to 20.45% (see Figure 1). Although the market share increased by 2.26% compared with the same period of 2008, it was slightly lower by 0.11% than the same period of last year.

Overall, the market share of low- and mid-end SUVs fell by about 5% in the first three years of the year - from 47.0% in the first half of 2008 to 42.2% in the first half of this year. Correspondingly, the market share of high-end and high-end cars has risen by about 5%.

Therefore, most self-owned brand SUV models compete in a shrinking market. The SUVs of joint venture companies only compete in the high-end and high-end markets.

Sales of self-owned brand models entering the high-end SUV market have shrunk

Since the beginning of this year, the highest growth rate of sales in the Chinese market (that is, the wholesale sales released by the CLUCC) is the SUV. In the first half of the year, the average growth rate of China's SUV sales has reached 110.0%. Most of the self-owned brand SUVs entering the high-end SUV market saw sales decline. For example, sales of the Cheetah CS6 in the first half of this year decreased by 9.14% from 2,188 vehicles in the same period of last year to 1988; Traca sales decreased by 10.22% from 2,367 units in the first half of last year to 2,125 units.

The joint venture models in the high-end SUV market enjoyed high growth. In the first half of 2009, the sales of the FAW Toyota RAV4 and GAC Toyota Highlander reached 39,559 vehicles and 47,065 vehicles respectively in the first half of this year. Shanghai Volkswagen Tiguan, which was just listed in March and April of this year, and Beijing Hyundai ix 35 had sales of 22,043 and 15,229 vehicles as of June.

The high-end SUV FAW-Volkswagen Audi Q5, which was launched in March this year, has also sold 9,005 vehicles as of the end of June.

It is not difficult to see from these data that the competitiveness of the autonomous SUV models in the high-end market is weak and difficult to survive.

The future of autonomous SUVs

Companies such as BYD, JMC, Geely, SAIC, and other self-owned brands have announced that they will launch new SUVs in the second half of this year. These vehicles are targeting high-end markets. The trend of self-owned brand SUV car companies going to mid- to high-end has emerged, but this road is bound to be difficult, especially as more joint-venture car companies launch more competitive SUVs in the Chinese market and make joint-venture car companies in this market. The competition is also very fierce, and it is very difficult for independent brands to win sales growth in this Red Sea. However, the declining market share of low-end and mid-range SUVs has forced autonomous vehicle companies to face difficulties.

In addition to the medium to high-end market, independent brands still have opportunities for development in the low-end and mid-range SUVs. In the first half of this year, sales of low-end and mid-end SUVs increased by 109.06% and 110.79% respectively year-on-year. In fact, many autonomous car companies are also deepening their opportunities for growth in the low-end market by improving product distribution at all levels of the market, improving marketing levels, and improving after-sales services.

Note:

The low-end car in this article refers to domestically produced SUVs with a price of less than 100,000 yuan, domestically produced SUVs with a mid-range vehicle index of 100,000 yuan to 100,000 yuan, domestically produced SUVs with medium and high-end vehicles, and high-end cars with a cost of more than 300,000 yuan. SUV.

XCMG Asphalt Concrete Paver,Asphalt Concrete Paver,New Asphalt Concrete Paver

Jinan Sinoheng Import and Export Co., Ltd. , http://www.challtruck.com